Consider a gold-backed IRA in your golden retirement

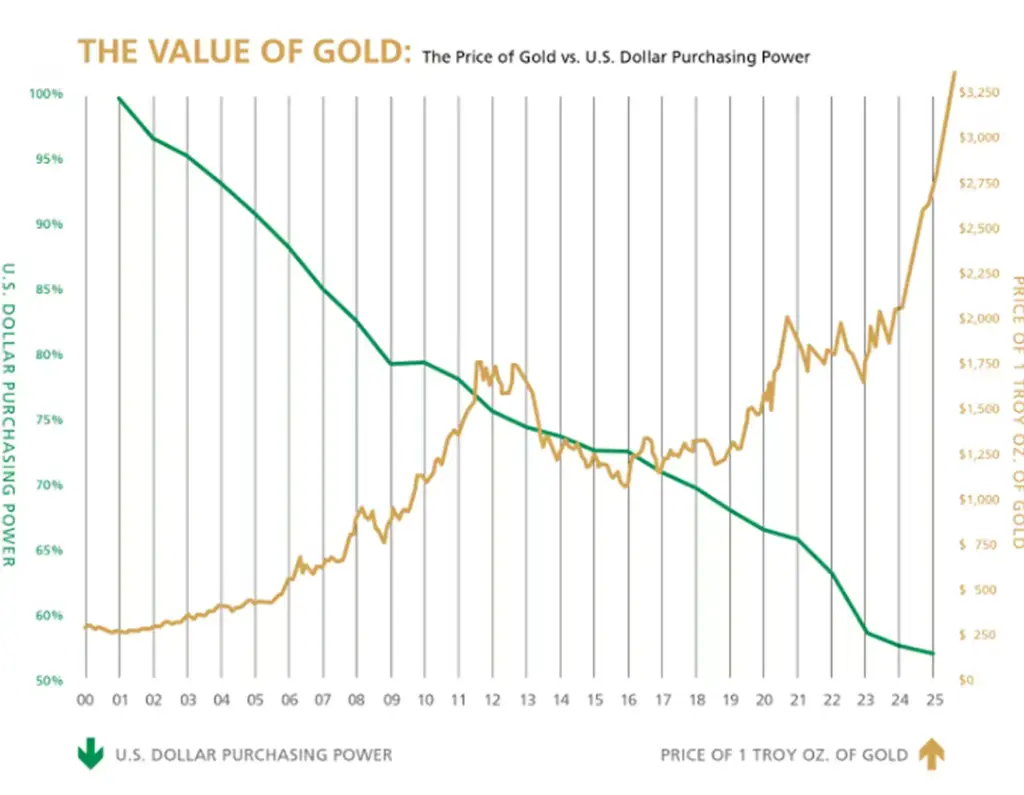

Adding gold and other precious metals to your retirement plan may help provide balance and protection during uncertain economic times. Trusted for generations, gold has long been seen as a way to help preserve wealth when markets are unpredictable.

Get Your Free Precious Metals IRA Kit!*

Learn why a Precious Metals IRA from Rosland Capital may potentially help protect your savings from market volatility.

Understanding Precious Metals IRAs

A precious metals IRA is a self-directed retirement account that holds physical gold, silver, platinum, or palladium instead of traditional paper-based assets. It's structured to meet IRS requirements and offers the same tax advantages as a traditional IRA.

People choose this type of account for various reasons—some want exposure to tangible assets, while others are looking for alternatives that may respond differently to market conditions. Like all retirement account decisions, it comes with both potential benefits and considerations worth understanding before making any changes.

Is a Precious Metals IRA Right for Your Retirement Goals?

Many people are exploring precious metals IRAs as a way to add balance to their retirement savings. Some are drawn to the tangible nature of gold and silver, while others appreciate the historical role these metals have played during economic uncertainty.

There's no one-size-fits-all answer. Taking time to learn about how precious metals IRAs work—and whether they align with your personal situation—can help you make a more informed decision about your retirement approach.

Get Your Free Precious Metals IRA Kit!*

Learn why a Precious Metals IRA from Rosland Capital may potentially help protect your savings from market volatility.

Call us today to discuss your self-directed precious metal-backed IRA options.

Worried about protecting your hard-earned financial assets? Here’s an idea that might help: a gold-backed IRA, or a precious metals-backed IRA - an IRA that holds precious metals instead of paper-based assets.Call: 1-833-264-2216

Protecting Your Retirement in an Uncertain Economy

What Gold and Silver IRAs Offer

Diversification

Protection in Uncertain Times

Inflation Hedge

Tangible Value

Tax Advantages

Peace of Mind

Setting Up Your New Precious Metals IRA Account

1

Learn About Your Options

2

Complete Your Forms

3

Open Your Accounts

4

Fund Your IRA

5

Secure Storage

6

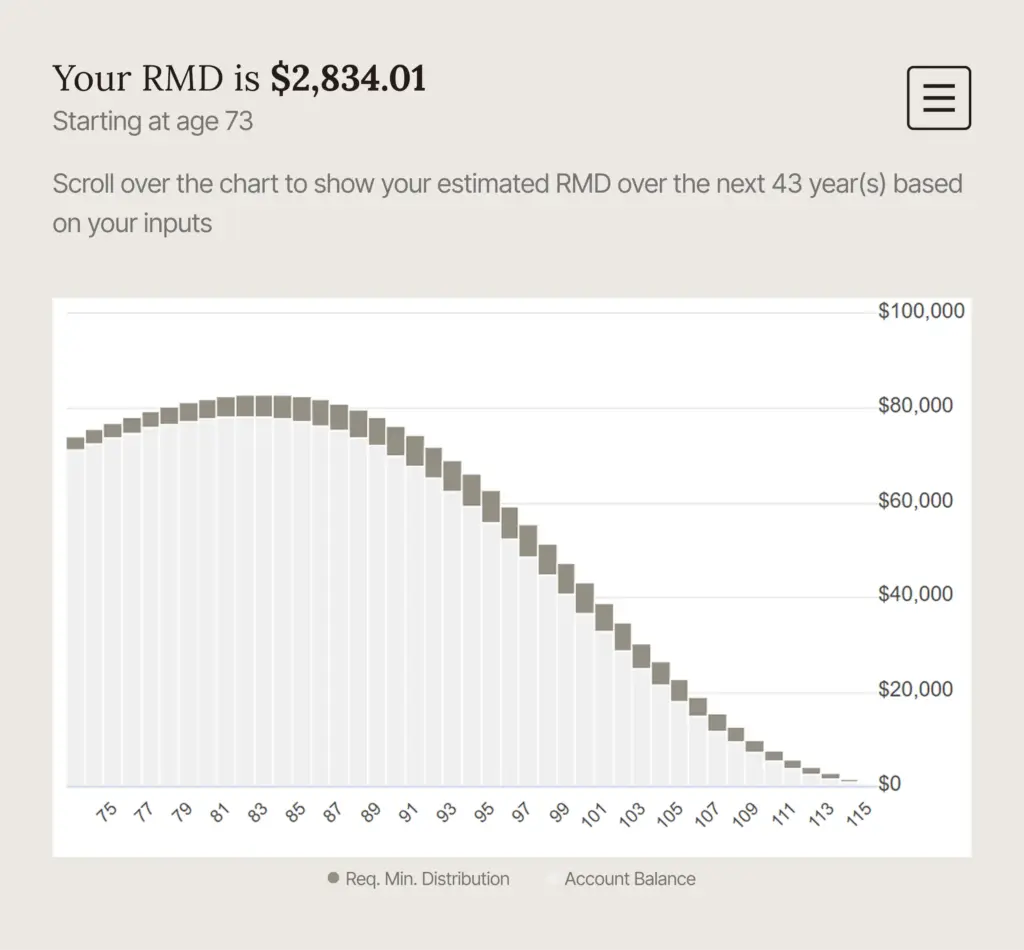

Taking Distributions

Required Minimum Distribution Calculator

Considering Home Storage for Your Precious Metals IRA?