Rosland Capital on Gold and Other Precious Metals

June 2025 News Digest

June 18, 2025

- The U.S. Mint launched the 2025-W $50 Uncirculated American Gold Eagle. This 1 oz, 22K gold coin, featuring the classic Saint-Gaudens Liberty design, was struck in West Point and has a limited mintage of 7,500.

- Military veteran Stephen Howard views coins as more than mere currency. His Tampa shop, Coinacopia, anticipates a return to historical precedents with gold and silver becoming legal tender in Florida in July 2026.

- The South African Mint’s Big Five Series III continues in 2025 with a gold and silver coin featuring the lion. These newly designed coins depict a roaring lion in full stance, celebrating both wildlife and conservation efforts. The rhino will be featured next in August 2025.

- The Perth Mint’s 8th annual Emu series for 2025 will feature new gold and silver bullion coins. These limited-mintage coins (30,000 silver, 5,000 gold) depict Australia’s famous emu with chicks in a desert and King Charles III’s effigy.

- Coin collectors are inspecting Australian $1 coins for a minting error, colloquially known as “spew roo” and characterized by a metal extrusion beneath the kangaroo’s mouth. These rare coins are valued at $5-$10 based on their condition.

- Near Norwich, England, a rare 7th-century Anglo-Saxon gold coin, considered East Anglia’s oldest, has been discovered. Featuring a dancing figure with a Christian cross over a Norse symbol, experts describe it as “massively significant.”

- Just two months after buying a used metal detector, Steve Hickman, inspired by BBC’s “Detectorists,” discovered a £50,000 hoard of 1,064 16th-17th century silver coins in Buckinghamshire. Believed to be a Civil War wage pot, it went to auction on June 12.

May 2023 News Digest

May 10, 2023

-

A man in Germany found a small treasure of gold bars and coins worth $147,000 while cleaning out a property.

-

Rosland released a new 1-kilo gold coin commemorating the winners of past Formula 1® Drivers Championships.

-

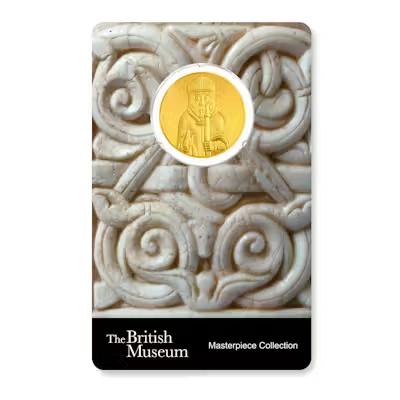

Rosland is excited to expand its collection of gold coins that feature pieces from the ancient Lewis Chessmen from the British Museum with this new Bishop ¼-oz gold coin.

-

To honor King Charles’ coronation, a new silver coin is being released with the traditional image of the crowned sovereign.

-

New Zealand has issued two silver and four gold coins to commemorate King Charles’ coronation.

-

Rosland CEO Marin Aleksov discusses the common uses for platinum.

-

The Franklin Half Dollar is celebrating its 75th year in circulation.

-

A collection of gold coins going back as far as the Civil War discovered in 2020 finally sold at a record-breaking price.

-

The first Dr. Sally Ride quarter struck on an incorrect planchet was auctioned at the end of April.

-

Learn about the roles that gold, silver, platinum, and palladium play in creating a more sustainable future, in this article from Rosland CEO Marin Aleksov.

-

Test your numismatic knowledge with this video from Coin Week that lets users guess the grade of an 1856 Gold Dollar “Upright 5”.

-

This year’s International Convention of Historians and Numismatists will be held in Santo Domingo and registration has now opened.

-

The American Numismatic Association (ANA) recently debuted a new webinar series called “NumismaTalks” hosted by a variety of industry leaders covering a number of topics related to coin collecting.

-

The Trade dollar, created by the U.S. Mint in 1873 is extremely rare, so naturally it has become a target for counterfeit coins.

-

The coins of Rosland’s Lewis Chessmen gold coin set are showcased in this video.

-

New York officials returned over $20 million of historic relics to Greece that had been smuggled and trafficked illegally, including a coin depicting Julius Caesar which had previously been sold for $3.5 million.

New 1-Kilo Gold Proof Lists All the F1® Champion Drivers

May 9, 2023

Rosland Capital is proud to offer a beautiful new 1-kilo coin, listing all the winners of the Formula 1 Drivers Championship, in sequence, from 1950 to 2022.

Accompanying the coin is a numbered Certificate of Authenticity. This includes a statement of metal fineness, weight, proof quality, and the signature of the independent assayer at PAMP.

Each 1-kilo proof is individually numbered on its edge and is supplied with a presentation case and a lucite display block. No more than 10 of these 2023-issue gold coins will be made.

April 2023 News Digest

April 11, 2023

-

While repatriating several ancient artifacts to Greece, New York has returned an “extraordinarily rare” gold coin that commemorated the assassination of Caesar.

-

A rare 120+ year old coin collection, valued at over $1 million, is to be auctioned for the first time.

-

The Executive Director of the Professional Numismatists Guild (PNG) presents tips for safety and protecting collections for anyone attending a coin show.

-

Rosland offers a number of limited edition gold and silver products, including bullion, commemorative, proof-quality, and graded numismatic coins.

-

MPC Fest, a meeting for collectors of military currency, held its first in-person event since 2019.

-

The first U.S. Mint was established in Philadelphia, the nation’s capital at the time, in 1792. Although the capital moved to Washington D.C., the mint remained in Philadelphia.

-

Gold and silver treasures from the High Middle Ages, over 1000 years ago, were discovered by a detectorist in the Netherlands.

-

The American Numismatic Association is accepting entries for its 2023 Barbara J. Gregory Outstanding Club Publications competition.

-

A 2004 Wisconsin state quarter from the 50 State Quarters Program may be worth up to $6,000 if it has a certain variation.

-

A gold coin with the oldest known reference to the Norse god Odin was found in Denmark, possibly changing the history of Norse mythology.

-

Palladium’s market value right now is especially high. Rosland CEO Marin Aleksov explains.

-

The U.S. Mint recently released the U.S. Army 2.5 oz Silver Medal, featuring designs by the mint’s Artistic Infusion Program (AIP)’s Lucas Durham, sculpted by Craig A. Campbell.

-

Rosland CEO Marin Aleksov discusses how gold and silver can potentially help individuals in maintaining financial stability during periods of economic uncertainty.

-

A British detectorist recently discovered an Anglo-Saxon gold pyramid sword mount.

-

Learn what makes ancient coins valuable, above and beyond just their age.

-

Stack’s Bowers Galleries Professional Numismatist Program, for students between 18 and 25, kicks off this summer.

-

Many collectors and dealers may have a rare and valuable die variety that’s historically been overlooked.

-

The Commission for Fine Arts has recommended a design for a congressional gold medal recognizing Willie O’Ree, the first black hockey player to play in the NHL.

-

The submarine “Nemo” that was used to locate sunken treasure from the California Gold Rush is coming up for auction.

-

The term “Coronet” is often used by coin collectors when referencing the 1899 $10 Liberty Gold Coin, referring to the crown on the head of Lady Liberty featured on the coin.

-

A rare Washington Quarter from 1946 was sold at auction for more than $3000, due to a unique D mint mark.

-

The US Mint’s 2021 American Liberty Gold Coin was the recipient of the 2023 Coin of the Year award.

Rosland Capital Adds New Gold Coin to British Museum Collection – The Bishop

April 6, 2023

The latest addition to Rosland’s coin collection created in collaboration with the British Museum is this gold Bishop – one of the famous Lewis chess pieces.

On the obverse side of the coin is Ian Rank-Broadley’s portrait of the late Queen Elizabeth II and the year of minting – 2023.

These new coins are .9999 fine gold, 22mm diameter, 0.25 Troy oz., legal tender proofs, minted by Swiss-based PAMP, one of the world’s finest producers of precious metal coins.

The packaging shows the back of one of the chess pieces and includes a Certificate Number, statement of metal fineness, weight, proof quality statement, and the signature of the accredited independent Swiss assayer at PAMP.

March 2023 News Digest

February 28, 2023

-

Starting in 2025, Mexico will replace its 20 peso bill with a 20-peso coin.

-

Formula 1 will debut its Las Vegas Grand Prix later this year. Rosland is proud to offer several commemorative F1 coins, including the ¼ oz Gold Coin 2022.

-

One lucky detectorist in the UK discovered a Victorian silver sixpence coin with a rare spelling error and connection to Cypress.

-

A popular social media numismatist offers tips for finding out if you have a valuable bronze penny from 1943 worth up to $265,000.

-

The Cincinnati Numismatic Association recently created the Gene Hessler Literary Award in honor of the long-time numismatic industry leader.

-

Over 50 rare coins from a 1686 shipwreck were recently sold at auction in the UK.

-

Have you seen our best-in-class Formula 1 coins honoring racing great Michael Schumacher?

-

The UK’s Royal Mint released their first Britannia bullion coin featuring King Charles III.

-

A gold-covered mummy was recently uncovered as archeologists continue to make discoveries at tomb sites in Cairo, Saqqara.

-

Detectorists in the UK uncovered 12 very-rare medieval gold coins from Edward III’s reign.

-

The Westmoreland, a ship that sank in Lake Michigan 150 years ago, has been home to $20 million worth of gold coins that were recently discovered in salvage operations.

-

Rosland is proud to honor tennis legend Billie Jean King with gold and silver coins exclusively licensed by the International Tennis Federation.

-

Numismatic TikToker Eric Miller recently featured his million-dollar Lincoln penny with a rare printing error.

-

A 500-year-old gold heart pendant linked to English monarch Henry VIII was recently uncovered by a detectorist in the UK exploring his friend’s backyard.

-

Since 1965, the US Mint has been using clad coinage, which led to a new mint error type: missing clad layer.

-

During a recent “Metal Detecting Rally”, a group of friends found a hoard of medieval coins worth $180,000.

-

This year’s Coin of the Year program honored a coin for Ukraine’s independence as its 2023 winner.

-

Many British citizens have been spotting a secret hidden symbol in King Charles III’s 50p coin since it’s been in circulation.

International Tennis Federation & Rosland Unveil Billie Jean King Cup coin collection

December 14, 2022

The International Tennis Federation (ITF) and Rosland Capital have released an exclusive gold and silver commemorative coin collection to celebrate the Billie Jean King Cup.

Each coin bears the portrait of Billie Jean King, her signature, and the logo of the Billie Jean King Cup. The obverse side features the late Queen Elizabeth II as portrayed by Ian Rank-Broadley, the coin’s face value, and the year of issue (2022).

All the coins are legal tender, 2022 issue, and minted as proofs – their highest level of quality – by Swiss-based PAMP, one of the world’s best-regarded private mints. All the gold coins are 999.9 fine gold, while the silver coins are 999.0 fine silver.

The coins’ protective package bears the Billie Jean King Cup logo and Ms. King’s signature, as well as the dynamic Billie Jean King Cup graphics which were such a standout visual element at the 2022 Finals in Glasgow.

The first coins to be offered are 50mm diameter 2.5 oz silver coins and 22mm diameter 0.25 oz gold coins. They will be followed by 1.5 oz gold coins, and 100mm diameter 1-kilo coins in gold and silver.

The back of the packaging acts as a numbered certificate of authenticity. It also includes a statement of metal fineness, weight, and proof quality, as well as the signature of the accredited assayer at PAMP.

The new coin range joins the growing Rosland Sports series, which has to date seen the release of specially licensed coins for distinguished sporting bodies and individuals such as Formula 1, the Keep Fighting Foundation inspired by Michael Schumacher, and the Ayrton Senna Institute as well as the PGA Tour, Fernando Hierro, Sir Jackie Stewart, Arnold Palmer Enterprises, and the Davis Cup amongst others.

Kelly Fairweather, ITF CEO, said: “We are very pleased to have worked with Billie Jean King Enterprises and Rosland on this collection and the results are fantastic. Billie Jean has brought fresh energy and excitement to this wonderful competition, and it’s fitting that we are able to celebrate her incredible achievements through this collection.”

Rosland Capital U.S. CEO Marin Aleksov said: “We are thrilled to celebrate such a great athlete, role model, and all-round wonderful human being. Billie Jean’s achievements on and off the court are an inspiration to us all, and especially to young players who can perhaps see themselves achieving more than they ever thought possible. The opportunity to continue our Rosland Sports series with such an iconic sporting figure is a real privilege. It is a source of immense pride to the Rosland team to have collaborated with Billie Jean on this project, and the results are outstanding.”

Follow Rosland Capital on Facebook, LinkedIn, YouTube, Twitter, and Instagram for the latest in precious metals news and exclusive coin collections.

December 2022 News Digest

December 5, 2022

-

The Numismatic Guaranty Company (NGC) has debuted a new 10-point grading scale in an effort to make the world of numismatics simpler and more accessible.

-

Sideshow Collectibles and the New Zealand Mint have recently created and released a new collection of gold and silver Batman coins.

-

In the 1970s, the US economy was hit with stagflation with a mix of high inflation and interest rates. Are we headed toward a similar economic situation today?

-

An ancient English gold coin estimated to be from the 1420s and recently discovered in Newfoundland could be the oldest English coin in Canada.

-

The 2022 São Paulo Grand Prix was full of exciting moments, from a scary collision in the beginning to George Russell’s first career win.

-

The Bank Negara Malaysia (BNM) will honor the golden jubilee of its capital city Kuala Lumpur with a new set of commemorative coins.

-

The Royal Mint’s 50th Anniversary Pride UK collection celebrates inclusivity, representation, and understanding.

-

Rosland CEO Marin Aleksov breaks down the fascinating history of modern monetary systems, starting with the gold standard.

-

Learn about the two types of struck-through minting errors and the impacts on the value of coins like the American Silver Eagle.

-

Find Rosland’s exclusive specialty coin collaborations with athletes and sports organizations on Instagram at @roslandsports.

-

Rosland is thrilled to announce the Fernando Hierro gold and silver coin collection, honoring the soccer legend.

-

Customers interested in 90% silver bags also explore half and quarter bags, values $500 or $250, respectively.

-

The American retirement age has increased from 62 to 66 in the last 10 years. Have you explored self-directed IRAs?

-

A 1000-year-old Viking settlement in Sweden turned up a 10th century coin, European coins, Arabic dirhams, and body jewelry.

November 2022 News Digest

November 1, 2022

-

Originally produced in Austria during the 16th century, the Austrian One Ducat Gold Coin is one of Rosland’s many coin offerings.

-

In October, the Royal Canadian Mint and Central Bank of Barbados won the IACA award for “Best New Commemorative or Test Circulating Coin” with their $1 coin that glows in the dark!

-

A collection of 44 gold coins from the Byzantine Empire was recently found hidden in a wall. Learn why someone may have hid these coins in a wall.

-

Rosland CEO Marin Aleksov explores working toward a more sustainable precious metals industry.

-

The U.S. Mint recently released the Franklin Pierce Presidential Silver Medal, which is part of a collection that includes coins featuring several of our nation’s early presidents.

-

The U.K. Royal Mint just released its first portrait of King Charles III as part of a special commemorative coin series that honors the life of Queen Elizabeth II.

-

Rosland Capital is happy to feature the South African Krugerrand Gold coin as part of its gold bullion collection.

-

A new Michael Schumacher coin joins Rosland’s Formula 1® collection for 2022. A portion of sales goes to support Schumacher’s Keep Fighting Foundation.

-

The Seattle Art Museum is now featuring several classical numismatic coins, like the Athenian tetradrachm and silver decadrachm from Syracuse.

-

In late September, the U.S. Mint announced its latest addition to the Armed Forces Silver Medals Program, with the 2022 coin honoring the U.S. Coast Guard.

-

Archeologists recently discovered a hoard of Islamic-era gold and silver coins behind an Egyptian temple.

-

Learn more about how to best care for your coins in this blog by Rosland CEO Marin Aleksov.

Is 2022 the Worst Hyperinflation Ever? In a word, no

October 31, 2022

We’re all feeling the pinch of inflation right now. According to many sources, it is the highest it has been in 40 years. But if we look to history, it’s clear that inflation has been as bad (or worse) as it is right now. For example, in the 1970s and 80s in the United States.

But what is hyperinflation? This article will look at the characteristics of hyperinflation and some of its causes.

What is Hyperinflation?

One of the most common reasons for inflation is directly related to supply and demand. If supply is low and demand is high, prices will rise, but usually, it’s not significant enough to make a huge difference in people’s lives. It’s called demand-pull inflation.

But when the price of goods and services rises more than 50% over a specific period, that’s called hyperinflation. When this occurs, people’s buying behavior tends to change. Occasionally there are supply shortages due to people overbuying or hoarding goods, especially food. Some may find paying their bills more difficult than in the past or put off certain purchases. Quality of life may also suffer.

As you can imagine, inflation of this type—hyperinflation—has significant consequences for the economy. But how does it happen? And what’s the prognosis?

The Americas in the 1970s

The most recent and perhaps most famous episode of hyperinflation in the United States was in the 1970s. This was a time of soaring inflation and interest rates, the combination of which led to what is known as “stagflation”—a period of economic stagnation combined with inflation.

In 1980, the annual inflation rate in the U.S. peaked at 13.58% and remained high for several years after that.

How Did This Happen?

Many blamed it on oil prices. The Arab-Israeli war in 1973 saw an embargo on oil coming into the U.S. A few years later, the Iran-Iraq war further contributed to a limited supply, resulting in an almost 70% increase in gas prices. Compared to today’s situation, we’re not quite there. Though we experienced a 58% increase in fuel costs over the past year, those statistics represent a rise after a significant drop in 2020, when demand was at an historic low.

Price and wage controls (monetary policy) implemented by the federal government at that time also contributed to inflation. These strategies allowed for growth in the money supply, leading to what some consider to be a failure of American economic policy.

Beyond U.S. Borders

But while the United States experienced high inflation in the 1970s and early 1980s, we were not alone. In particular, countries in South America were dealing with hyperinflation.

For example, in 1974, Chile’s inflation rate reached 746%. By comparison, the highest inflation rate in the United States during that time was 11.04%.

All things considered, it could have been worse in the U.S. Even in periods of high inflation, the U.S. has yet to experience the levels of hyperinflation that plague other parts of the world.

Yugoslavia 1992-1994

Yugoslavia claims the third worst and second most prolonged hyperinflationary period in modern history.

Economic mismanagement by the government, military conflict in the region, excessive deficit spending, and political instability all contributed to the situation. The country accepted an IMF loan, which some observers say was mismanaged. Money was over-printed, large deficits were amassed, price controls were enacted, and many companies simply stopped paying employees so they could avoid bankruptcy.

Some stores chose to close and retain their inventory because selling their stock would put them at a loss. Goods were scarce. In the midst of the crisis, unemployment was almost 25%.

In January 1994, inflation peaked at 313 million percent, rising more than 64% daily. By some estimates, prices increased by five quadrillion percent during this time.

Before 1991, the country’s annual inflation rate was 76%, but things were about to become much worse. Even after converting one million dinars to one “new” dinar, the Yugoslavian dinar was so undervalued that the German Deutsche Mark (DM) became the preferred currency. At this point, one million “new” dinars equaled one DM. After five revaluations, the Yugoslavian government issued a “super dinar,” the equivalent of 10 million “new new” dinars.

Zimbabwe 2007-2008

In 2008, Zimbabwe entered a hyperinflationary period in which prices doubled every 24 hours. The highest monthly inflation came in November 2008, when rates hit 79.6 billion percent. At this point, 500,000 Zimbabwe dollars (ZWD) was equal to USD $0.25.

The South African rand became the accepted currency until the Reserve Bank of Zimbabwe stepped in, closed the country’s stock exchange, and balanced the ZWD to the US dollar.

Many said the debacle had its roots in the country’s governmental incompetence. Supply dwindled as a result, and prices increased, setting off a chain of events that led to its economic collapse.

Zimbabwe’s then-leader, Robert Mugabe, printed excess money to pay off IMF loans and civil servant salaries. Food, fuel, and medical supplies were scarce. As prices of goods soared, the government implemented a wage freeze, further impacting Zimbabweans’ ability to purchase even the most basic goods and services.

Eventually, they ran out of paper to print money, as paper suppliers in Europe refused to sell to them based on humanitarian concerns.

Venezuela 2017/2018

In 2017, Venezuela was on the brink of an economic crisis. They had struggled with inflation for many years amid political and socio-economic instability, finally reaching a peak in 2018 under the controversial leadership of Nicolás Maduro. In 2014, they achieved the dubious honor of the highest inflation rate in the world which continued to multiply. By the end of 2019, the IMF estimates that the inflation rate in Venezuela was 10,000,000%.

The situation in Venezuela is an example of how quickly hyperinflation can spiral out of control. In just a matter of months, the country went from one of the richest in South America to the brink of collapse.

So, how did one of South America’s most stable democracies, a nation so rich with petroleum that they once provided free oil to heat Americans’ homes in NYC, reach that point? For a country that at times has produced more oil than Saudi Arabia, it would seem unthinkable.

Causes point to over-printing of money and deficit over-spending, coupled with sinking crude oil prices. Some pointed to U.S. sanctions against Venezuelan oil, gold, and the Central Bank of Venezuela as well as the PDVSA, Venezuela’s state-owned oil and gas company.

The sanctions, meant to put pressure on Maduro’s regime, hindered the country’s paths to financing. To counter the sanctions, they continued to sell oil and gold at deep discounts to countries like Russia and India, often in exchange for imported food and medical supplies.

PDVSA’s mismanagement has also been blamed for their economic woes.. Equipment was not maintained, resulting in a substantial reduction in drilling rigs, extended downtime, and higher accident rates. At the end of 2020, there were no PDVSA rigs in operation. According to the Cato Institute, the PDVSA has destroyed more economic value than any institution in history.

The Road to Recovery for Venezuela

Venezuela wrapped 2021 with an inflation rate of 686%. While that’s nowhere near what we could call “recovery,” it was an improvement from the hyperinflation of just a couple of years ago. By January 2022, the preferred currency had become the U.S. dollar, and monthly inflation had dropped to under 50%.

Despite the positive trend, consumer confidence is low. Citizens are still reeling from a time when the currency would spectacularly plummet daily, and that’s not bound to change overnight.

Are We Headed for Hyperinflation?

The Federal Reserve reports inflation at 8.2% in September 2022, which lends some context to the extreme crises described above.

Though some believe that government stimulus packages could contribute to situations similar to hyperinflation, it is improbable. Inflation is part of a country’s typical economic ebb and flow.

Every country experiences it at some point, and it’s not something that “ends” or comes to a stop.

In the view of some economists, it just gets less bad.