Rosland Capital on Gold and Other Precious Metals

Rosland Announces New Proofs Made Under Exclusive License from Formula 1®

April 29, 2025

Rosland Capital is now making available 2025-mintage Formula 1 limited edition gold and silver coins celebrating 75 years of the most prestigious championship in motor racing.

The beautifully-crafted commemorative coins list all 32 countries that have ever hosted a Formula 1 Grand Prix, with the official F175 logo shown in the center of the coin. On the obverse side of the coin is the official effigy of King Charles III.

The packaging includes a Certificate Number, statement of metal fineness, weight, proof quality statement, and the signature of the Assayer at PAMP.

The gold coins are 999.9 fine gold, 0.25 Troy oz., while the silver coins are 999.0 fine silver, 2.5 Troy oz.. All coins in the collection are legal tender and minted by Swiss-based MKS PAMP, one of the world’s finest producers of precious metal coins.

March 2022 News Digest

March 13, 2022

-

Rosland CEO Marin Aleksov talks about the many uses of platinum.

-

The Perth Mint releases a “Year of the Tiger” silver coin for 2022 celebrating Lunar New Year.

-

The first silver dollar coin struck by the United States was recently acquired for $12 million!

-

A UK man discovered a gold coin from the 13th century, now worth almost $900,000, on a metal detecting trip with his children.

-

As Americans see prices increase, Rosland contributor Lawrie Williams covers how rapid inflation affects gold.

-

Learn about the establishment of mints in North Carolina and Georgia in the 19th century.

-

Discover some of the most popular precious metals mints and brands.

-

King Tutankhamun’s belongings, including many gold relics, is to be displayed at the Grand Egyptian Museum starting in late 2022.

-

Originally minted in 1936 in San Francisco, these rare Chinese silver coins are examples from China’s transition from a silver to fiat currency.

-

The Royal Mint is auctioning a rare “pattern piece” celebrating the Una and Lion coin design this month.

-

Coin collecting and numismatics is becoming more and more popular among young people.

-

A gold coin from the Roman Empire featuring assassinated emperor Volusianus has been found in Hungary.

-

What is an “object biography”? It’s a scholarly method of researching the changing relationships between peoples and things – and is commonly used to study coinage throughout the ancient world.

-

The Croatian National Bank recently released its first colored gold and silver coins to celebrate the Dalmatian dog which originated in Croatia’s Dalmatia region.

-

A UK metal detectorist recently discovered a rare gold “leopard” coin from 1344.

Bitcoin vs. Gold: Marin Aleksov Explores the Basics

March 7, 2022

Gold vs. Bitcoin

It’s time to talk about gold vs. Bitcoin. The rising popularity of Bitcoin and other cryptocurrencies has many people pitting gold and Bitcoin against each other. A host of unfamiliar terms come along when discussing Bitcoin. New terms such as blockchain, cryptocurrency, and NFTs often keep people from fairly considering the merits and challenges of these two asset classes. Understanding how it all works can be challenging and make Bitcoin and NFTs appear mysterious or not worth the trouble to learn about.

However, with Bitcoin often called the “new gold” or digital gold by crypto enthusiasts, it’s worth the time to learn about why this debate about gold vs. Bitcoin is so hot lately. Gold and Bitcoin are often presented in contrast, as opponents or opposites, with one often declared the winner. But is that really the case, and is it fair to gold, Bitcoin, or people seeking to diversify their assets?

What is Bitcoin?

To state it simply, Bitcoin is a digital currency circulated and managed using decentralized peer-to-peer technology called a blockchain, or distributed ledger, meant to increase transparency and security of financial transactions.

The concept of a decentralized currency means that central banks, financial institutions, and governments do not carry out, own, or control transactions. Instead, the network of peers distributed across the globe manages these transactions and issues bitcoins.

Created in 2009 by a pseudonymous person or group called Satoshi Nakamoto, Bitcoin is the most well-known cryptocurrency, and by far the most highly valued.

Blockchain

Blockchain is the digital collection of recorded transactions often called a distributed ledger because the records are publicly available and exist in multiple locations across the peer-to-peer network. Each “block” in the chain is nearly unchangeable, making it difficult to retroactively alter without the consent of every peer in the network.

Any changes to the blockchain require the creation of a new block, which is done using cryptography. Peers, or nodes, in the network provide computing power to solve incredibly complex equations used to build and complete each block or record in the ledger. Bitcoin miners are rewarded for supplying the computing power to the blockchain, earning bitcoins in a digital wallet for each completed block in the chain.

Blockchain technology was developed as the operating structure for Bitcoin. However, blockchain has been adapted to create different cryptocurrencies such as Ethereum, Litecoin, and others.

So far, over 10,000 different cryptocurrencies now exist. Among these are varieties referred to as “meme coins,” of which Dogecoin and Shiba Inu are the most popular. Many celebrities have gotten on the crypto bandwagon. Notable names like Elon Musk, Tom Brady, and Kim Kardashian have promoted different cryptocurrencies.

Where do NFTs fit into the world of cryptocurrency?

An NFT, or Non-Fungible Token, is a one-of-a-kind digital asset or non-interchangeable unit of data stored on a blockchain, used to represent physical objects such as art or real estate as well as digital items including songs, videos, and images.

The NFT represents the owned object, links ownership digitally in a blockchain to an individual and allows ownership to be sold and traded, with each transaction recorded in the blockchain. Most NFTs exist on the Ethereum blockchain.

As markets for NFTs and cryptocurrencies heat up alongside inflation concerns, some call Bitcoin the new gold. But what does that mean?

Why do people buy gold?

Gold is a precious metal valued across cultures and societies since ancient times. For thousands of years, people agreed upon gold as a physical store of wealth that maintains value across social, cultural, and national boundaries. The gold standard determined the value of a nation’s government-issued currency by how much gold the government had. Gold served as the foundation for the national currency.

Many countries have disconnected currencies from the classic gold standard, making the nation’s paper money and coins a fiat currency. But gold still retains value and remains a popular hedge against market volatility and inflation. This makes owning physical gold (and other precious metals) a popular way to help protect the value of wealth and assets in comparison to the relative volatility of the stock market or in the face of possibly spiking inflation.

Although gold is not necessarily expected to increase the value of assets or deliver growth like stocks sometimes can, the charm of gold for many people is that by comparison, its value can be more stable than securities like stocks and bonds

What does it mean when people say that Bitcoin is the new gold? How do gold and Bitcoin compare?

Gold and Bitcoin compared

How is it possible that gold and Bitcoin can be compared or even thought to compete? After all, gold is a physical precious metal mined from the earth, refined, and formed into ingots, bars, coins, and rounds.

Bitcoin is a digital form of currency that technically exists only as computer code, as digital information. Get rid of the servers and Bitcoin (along with every other cryptocurrency) disappears. Melt down all the gold bars and coins and the gold is still there, albeit in a different form. However, the likelihood of every computer disappearing seems about as likely as making gold cease to exist.

In some people’s eyes, there are parallels between gold and Bitcoin, in particular. For example, gold is available on Earth in limited quantities, while Bitcoin supplies are also finite. Beyond that gold, unlike paper money, cannot be printed by a government, and Bitcoin is not something a government can issue more of, to cover its needs.

Now let’s take a look at some of the main differences between gold and Bitcoin.

Gold

Pros

-

Unmatched history as a store of value.

-

Physical metal that exists in a specific place.

-

Relatively stable value historically when compared to the volatility of stocks.

-

More easily accessible to more people who want to buy it.

-

It’s aesthetically pleasing! It’s just a beautiful material.

Cons

-

Although a possible hedge against inflation and market volatility, using gold as currency for everyday purchases is not a practical proposition. For one thing, the melt value of your gold coin on any given day may be more than its melt value the next day, whereas a dollar in fiat currency is still technically worth a dollar every day, even if what that dollar can buy you changes over time.

-

With low volatility comes less potential for growth, although it’s important to understand why you want to buy gold to diversify your assets in the first place.

Bitcoin

Pros

-

Digital currency is not confined to a single physical space.

-

Highly liquid currency can be used across increasingly wider markets.

-

Has shown high growth potential.

Cons

-

Bitcoin and other cryptocurrencies are still very young, especially compared to gold.

-

The value of Bitcoin remains highly volatile.

-

Bitcoin is still not as widely accepted as gold.

-

Potential for government regulations and restrictions is still high and may impact valuation, liquidity, and utility.

-

Subject to wild price fluctuations merely by celebrities making statements on social media.

-

Limited transactions-per-second. Bitcoin transactions depend on the blockchain, and processing each transaction is much slower than the speed at which traditional credit card companies can process transactions. For comparison, Bitcoin processes 7 transactions per second; Visa processes around 1,700 transactions per second on average, with estimates as high as 24,000.

-

Environmental concerns. Bitcoin’s energy consumption is exorbitant, so anyone with environmental concerns may want to think about that before purchasing. Some reports state that each Bitcoin transaction consumes 1,173 kilowatt hours of electricity, enough energy to “power the typical American home for six weeks,” the authors add.

Comparing and contrasting gold and Bitcoin shows some important distinctions to keep in mind when considering which may make sense for you.

Framing Bitcoin as the new gold or pitting gold against Bitcoin as though the two are mutually exclusive establishes a false opposition. Gold and Bitcoin are different, certainly, with different costs and potential benefits, but that does not make them opposites or mutually exclusive.

Although Bitcoin value is not pinned to a physical object, digital assets such as NFTs are linked to real-world objects as sources of value much like gold serves as a source of value.

How do I choose between gold and Bitcoin

If you buy gold, it doesn’t mean you can’t buy Bitcoin, and vice versa. This debate is likely to remain a lively one as long as markets remain volatile and one camp sees the other as capturing capital and market value that they assume would otherwise be going into either gold or Bitcoin.

Regardless, be sure to do thorough research into gold and Bitcoin before making any decisions. People choose different options for different reasons. When buying Bitcoin or gold, be sure to include researching spot prices and check out these tips for buying gold, especially if the coins are purchased as a means to protect wealth. Make sure you understand the different ways you can buy gold, some of which include gold coins, bars, and gold IRAs.

It remains important for each person to understand what each asset does and how it may fit into their financial strategy.

Get more information about why you might buy gold.

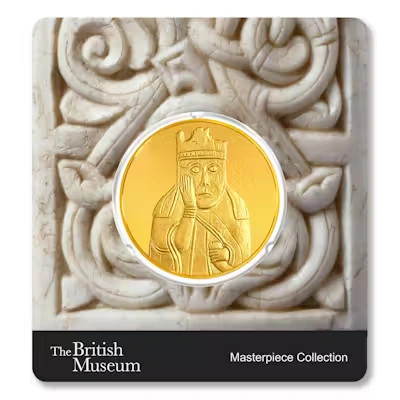

Rosland Capital Adds New 1.5 oz Lewis Chess Piece Gold Coin to British Museum Collection

March 2, 2022

The latest addition to Rosland’s coin collection created in collaboration with the British Museum is this gold Queen – one of the famous Lewis Chess Pieces, and one of the most characterful, with her troubled look and drinking horn.

On the obverse side of the coin is Ian Rank-Broadley’s portrait of Her Majesty Queen Elizabeth II and the year of minting – 2022.

These new coins are .9999 fine gold, 40mm diameter, 1.5 Troy oz., legal tender proofs, minted by Swiss-based PAMP SA, one of the world’s finest producers of precious metal coins.

The packaging shows the back of another of the chess pieces – the Bishop – and includes a Certificate Number, statement of metal fineness, weight, proof quality statement, and the signature of the accredited independent Swiss assayer at PAMP.

February 2022 News Digest

February 15, 2022

-

A 400-pound, 24-karat gold cube has been erected in New York’s Central Park by the artist Niclas Castello who also plans to launch a new cryptocurrency.

-

A recent survey found that automakers are switching from palladium to platinum for catalytic converters. What impact will that have on the price of both metals?

-

Contributing writer Lawrie Williams reiterates the stability of gold over time.

-

Rosland CEO Marin Aleksov covers some of the most impressive finds of buried treasure from detectorists.

-

In a private transaction, a 1907 Saint-Gaudens Ultra High Relief gold coin has been acquired for $4.75 million.

-

Curved gold coins, known as “rainbow cups” were found in Germany. These coins, estimated to be from between 125 and 30 BCE are thought to have arrived in Germany via trade routes with the Celts.

-

Did you know that Rosland has joined with the British Museum to craft beautiful coins from the Masterpiece collection? Check out some of the Lewis Chessmen pieces.

-

Recent discoveries of gold along the Great Steppe have been featured in their own exhibition at the Fitzwilliam Museum.

Inflation Calculations and Gold

February 10, 2022

It’s not only this writer who is distinctly nervous about the US Federal Reserve Bank’s more aggressive approach to attempt to control inflation. This approach has come after numerous suggestions over a period of months that the problem did not exist and any inflationary tendencies were but ‘transitional’.

Other central banks around the world followed the Fed’s mantra but, despite this, global inflation now seems to be running at levels not seen for a couple of decades. Some previously strong economies are seeing near hyperinflation figures – take Turkey for example where inflation is running at close to 50%.

This makes even US levels where the Consumer Price Index (CPI) has hit 7% look modest while even in Europe most countries seem to be hitting inflation levels of well above 5% – and that is on official figures which may underestimate the true picture.

Of course governments around the world, the US included, have nearly all followed the path of moving the inflation calculation goalposts to make figures perhaps look even more respectable than they really are. And the Fed uses yet another inflation measure, the Personal Consumption Expenditure (PCE) Index, which tends to track even lower than the CPI, on which to base its decisions.

By contrast John Williams’ Shadowstats service utilizes the old US methodology for calculating US domestic price increase statistics. These suggest that on this basis US inflation is currently at the even more worrying level of near 15%.

Investopedia defines inflation as the decline of purchasing power of a given currency over time. It is usually calculated as an estimate of the rate at which the decline in purchasing power occurs as reflected in the increase of an average price level of a basket of selected goods and services in an economy over a specific time period.

The selection of what is included in this basket, though, is defined by the body calculating the resultant figures, which leaves it open to the possibility of manipulation .

The figures do not tend to revert, however, if the political control switches to a government of a different persuasion following an election. Governments do have an interest in presenting their domestic economies in a favorable light and lower calculations tend to be clung to whatever the political direction of the political party in power.

A common way of protecting one’s assets against the potential ravages of inflation is investment in equities which, over time, tend to more than compensate in growth terms for levels of annual price inflation of around 2 or 3% seen as acceptable increases by most governments and central banks.

However, there is some aggressive tightening under way, as we are beginning to see in North America and Europe. This has been implemented in the light of above-target inflation levels of 5-7%, but perhaps higher, and could put a severe dent in stock prices that had become used to positive swings from central bank largesse.

If this economic stimulus is brought to an end, or is reversed as seems to be new central bank policy around the world, it could swing purchasers towards traditional safe haven assets like gold which tend to hold their value regardless.

Gold does not itself generate interest, which is often seen to be to the advantage of equity investment in more normal times. But when, as now, inflation is running at a far higher level than the rate that the central banks can raise interest rates, real world rates effectively become negative.

This could make assets which do not generate interest, but tend to hold their value, a preferred asset protection category. Gold fits into this category, which is why it may be coming into its own again.

by Lawrence Williams

Lawrence (Lawrie) Williams is a highly regarded London-based writer and commentator on financial and political subjects, specializing in precious metals news and commentary. He graduated in mining engineering from The Royal School of Mines, a constituent college of Imperial College, London. He has contributed articles on precious metals to the Financial Times, Sharps Pixley, US Gold Bureau and Seeking Alpha among others.

The opinions expressed in this article are the author’s own, do not necessarily reflect the opinions or views of Rosland Capital LLC or its employees, and do not constitute financial or investment advice or recommendations from the author or Rosland Capital or its employees. The author is compensated by Rosland Capital for his articles.

Gold Has Stood the Test of Time

January 26, 2022

Over the past few weeks and months the gold price has seen several rallies taking it back above the $1,800 level. Each time, to date, it has been unable to hold on to this price improvement. Likewise, silver has hovered above and below the $23 level and yet again brought down a fraction below this at the close of last week’s trading.

However both started the current week in positive territory in European trade. It remains to be seen whether this positive note will transfer to the North American markets as the week progresses.

Gold moved back above what is turning out to be the key $1,800 price parameter about a week ago, and so far has held on to most of its gains. It remains to be seen if this price will hold, especially in light of the increasing likelihood that seemingly ever-rising inflation will force the Fed’s hand in terms of raising interest rates more aggressively than it had previously indicated. This would be an attempt to try and bring the inflation dragon under some semblance of control, although such a solution may well prove to be too little too late.

There are several key economic indicators that may move on Fed tightening cycles this year. It is well worth examining, though, what has happened to some of these indicators in past such attempts by the Fed to exert controls of this type. The indicators I will look at specifically are the strength of the dollar index, the movement in the S&P 500 equity index and the gold price. All of these can have an effect on the strength of the US economy and the public’s perception thereof.

The reactions to the Fed’s past periods of tightening, which have mostly tended to be pretty short lived, have often been counterintuitive in the longer term from the implementation of a period of generally higher domestic interest rates. During the past five attempts by the Fed to tighten monetary policy, for example, this has led to a somewhat mixed performance by US equity markets, as represented by the S&P 500 index, and an average weakening of the US dollar, together with a subsequent rise in the average gold price.

There is certainly a worry after what many see as an unsustainable boom in equity prices. Additional uncertainty abounds because of the coronavirus situation.

Any such deterioration in equity price indexes would be a visible change that could result. And, if it happens, there could well be a decision by the Fed to reverse its tightening measures after only a relatively short space of time, as has seen to be the case in the past.

The Fed has, to date, been somewhat diffident in undertaking any policy that might be seen to depress the most visible signs of US economic growth. It may thus be able to live with a more cautious approach to rising interest rates than many economists and media commentators have suggested.

After all, the US central bank has lived with a prolonged period of well-below target inflation and may be prepared to accept a more cautious approach to rising interest rates in the interests of bringing the average up – at least for a few more months yet. Any drastic moves on interest rates could well see a major headwind for the Fed in meeting its unemployment rate and economic growth targets.

Even if the Fed speeds up its interest-rate raising decisions, any increases are unlikely to lift real rates into positive territory – at least for 2-3 years – given the current strength of inflation. Many see it continuing to rise in the short-to-medium term. This would mean real interest rates remaining in negative territory for some time yet. Negative real rates have almost always been positive for the gold price.

If, however, there is a more aggressive approach to interest rate increases, equity prices could well fall as a consequence, which could lead to gold price strength.

Gold has a long history, dating back thousands of years, as a way to help protect against the inflationary impacts on currency buying power. The same can be said of silver, which would also likely benefit as its price still seems to move pari-passu with gold, even though its main markets these days tend to be in the industrial sector. As they almost always have, gold and silver would thus continue to act as wealth protectors in uncertain economic times.

by Lawrence Williams

Lawrence (Lawrie) Williams is a highly regarded London-based writer and commentator on financial and political subjects, specializing in precious metals news and commentary. He graduated in mining engineering from The Royal School of Mines, a constituent college of Imperial College, London. He has contributed articles on precious metals to the Financial Times, Sharps Pixley, US Gold Bureau and Seeking Alpha among others.

The opinions expressed in this article are the author’s own, do not necessarily reflect the opinions or views of Rosland Capital LLC or its employees, and do not constitute financial or investment advice or recommendations from the author or Rosland Capital or its employees. The author is compensated by Rosland Capital for his articles.

Bitcoin Volatility and Gold

December 15, 2021

Many observers have stated that the seemingly non-ending rise in the value of Bitcoin has diverted a significant amount of investment dollars away from gold as a perhaps better form of wealth protection and accumulation.

This is despite gold’s record over thousands of years as an excellent safe haven against currency depredations through war, plague, famine, inflation and economic collapse, to name but a few.

Others have considered the rise of Bitcoin as a total economic illusion and the epitome of an investment bubble – and I put myself in these latter ranks – but I have certainly been proved wrong.

Over the years Bitcoin has been in existence, it has gone through various growth phases and collapses, although so far the latter have proved to be relatively temporary in duration. The price of a single Bitcoin has, over a matter of around five or six years, achieved an enormous growth in value and made huge fortunes for those who have exited and got their buying and selling timing right.

A BTC Bitcoin has risen to over $60,000 at one time, but for an asset that has nothing behind it but computer code, one can easily understand Bitcoin skeptics.

These include some well-known economic brains out there, who consider it a total financial anomaly verging on a scam. It has also, in a somewhat worrying contrast, attracted some proponents who have dubious past financial histories.

In many ways, Bitcoin could be considered a gigantic Ponzi scheme. As long as buyers pour money into it, its price will keep on rising.? Indeed some seemingly astute financial brains, who are not necessarily dishonest in expressing their financial views, have touted an almost infinite price potential for Bitcoin and other cryptocurrencies.

However, I have been brought up to believe in the old, and well-proven, adage that if something seems to be too good to be true, it almost invariably is, and I would place Bitcoin firmly in this category.

Bitcoin can be prone to enormous short-term value swings, as it did recently, when it saw its price almost free falling down to the low $40,000s.

OK, still a huge price for what is effectively a piece of code on a computer, but also around $20,000 short of its peak of less than a month earlier. It has since bounced back, but remains prone to similar meltdowns as we have seen in the past. The latest meltdown is one of several this year.

Bitcoin is often promoted, among other things, as a wealth protector, but in truth it could be considered a gamble on its continuing price rise. There are plenty of ‘pundits’ out there who will tell you it is poised to rise to unimaginable heights.

However, some of these will have vested interests of some kind or another in trying to persuade you to put some, or even all, of your accumulated wealth into cryptocurrencies. But, it is sometimes difficult to separate these from the true honest believers in the crypto universe.

Gold, on the whole though, is less prone to wild fluctuations in value. It may be going through a weakish phase at the moment (perhaps a good buying opportunity?), but even in its worst temporary price collapse has never fallen by near 20% in a single day, or 30% in a month.

Gold, in contrast to Bitcoin and other cryptocurrencies, has stood the test of time. Even in its darkest days gold retains some value. . Bitcoin may not be able to say the same thing in the midst of a global financial collapse.

So, by demonstrating its vulnerability to enormous rapid price collapses, as happened recently, Bitcoin may have generated some doubt among the crypto faithful. Gold may not have the potential to make you super-rich, but it does have the attribute of helping to protect what you already have. In 5,000 years, we will see if Bitcoin can say the same.

by Lawrence Williams

Lawrence (Lawrie) Williams is a highly regarded London-based writer and commentator on financial and political subjects, specializing in precious metals news and commentary. He graduated in mining engineering from The Royal School of Mines, a constituent college of Imperial College, London. He has contributed articles on precious metals to the Financial Times, Sharps Pixley, US Gold Bureau and Seeking Alpha among others.

The opinions expressed in this article are the author’s own, do not necessarily reflect the opinions or views of Rosland Capital LLC or its employees, and do not constitute financial or investment advice or recommendations from the author or Rosland Capital or its employees. The author is compensated by Rosland Capital for his articles.

Gold and Silver Double Whammy

November 29, 2021

Just when I’d felt that gold and silver prices were due for a nice upwards surge, they were hit by a double, or even triple, whammy and lost their recent gains. That was until they saw a pick-up in Europe over the US Thanksgiving holiday due to the emergence of a worrying strain of a new coronavirus mutation in Africa.

I was somewhat at a loss to explain why they were so badly affected initially and believe they will continue to recover when more rational analysis returns. I could be mistaken, though, as, in this writer’s view, current markets are behaving far from rationally.

Firstly, let us consider the two events that primarily had such a negative effect on precious metals when things had previously looked to be going swimmingly for them.

At the end of the previous week, a speech by Fed governor Christopher Waller seemed to have an adverse impact on prices. Waller is considered to be one of the more ‘hawkish’ figures on the Fed’s board so his views on what path the central bank should follow, given the current inflation worries, should not have come as a surprise to anyone.

Waller was advocating a more rapid tapering process than the Fed had appeared to be following, in turn leading to a possible raising of interest rates perhaps a little sooner next year than had previously been envisaged.

The publicity appeared to contribute to a drop in the price of gold, which previously had looked to have been consolidating around the $1,860 level. It also appeared to help shave more than a dollar off the silver price, which had earlier regained the $25 mark, still well below where many silver bulls feel it should be.

But this was only the half of it!

On Monday morning last week, just as U.S. markets were opening, President Biden announced that he would be nominating existing Fed chair, Jerome Powell, for another 4-year term in this position. This news, although not unexpected, seemed to have the effect of taking gold back to the $1,780s.

To me, the market reaction to this was even more irrational than that to the Waller statement. Powell may have been a Trump appointee, but he plowed his own furrow, frequently at odds with the views of the former President.

Powell has been largely responsible for guiding the Fed through its so far relatively ‘dovish’ tapering policy and in keeping interest rates ultra-low. He had been pretty adamant that the recent Fed program of tapering and retaining low interest rates would continue until unemployment fell to the supposed ‘maximum’ level of around 3.5% – the point where it had settled pre-Covid pandemic.

Perhaps the markets had been assuming that Powell would be let go and replaced by Fed governor Lael Brainard, who was thought to be even more ‘dovish’ than Powell. As it turned out, Brainard was appointed to the position of Fed vice chair, which puts her in line to take over the Fed’s top position when Powell’s new term ends in 2026 – although a possible change in the Presidency in 2024 could make this less than a certainty. Powell’s re-appointment strengthened the dollar too, which was also seen as something of an additional negative for precious metals prices (another whammy!).

I don’t read these events in the same way most of the market seems to be doing. Firstly, the market reaction was almost certainly overblown, as usually seems to be the case . I envisage Powell as continuing on the current tapering and interest rate course, while Waller may well remain crying in the wilderness, particularly if potentially three new Biden appointees to the Fed board, as existing board members are due to stand down, are of the dovish variety in the Brainard vein, as would likely be the case.

The Fed’s preferred inflation measure, the Personal Consumption Expenditure (PCE) Index came in this week at 4.1% which may still be low enough to encourage Powell and the Fed board to maintain the current overall policy.

The reading still suggests inflation is running strong, but perhaps not as high as many observers and commentators have been suggesting. True, the PCE index tends to report lower than the Consumer Price Index (CPI), which perhaps better reflects the real experience of the general public. However, it is an index the Fed tends to take seriously. . That said, a few months of inflation at a little above 4% may not dishearten the Fed board given the original 2% inflation target had been undershot for so long. Higher inflation levels may just serve to bring the average back to what the Fed considers to be the ideal rate.

On Friday, at least in Asia and Europe, gold did recover some of its lost ground demonstrating its volatility around news items considered as favorable or unfavorable by the market movers.

However, it was brought back down again when US markets opened, closing the week lower in the mid $1,780s again. It has opened stronger in Asia and Europe again recently, demonstrating upwards gold price pressure outside North America, but it still remains to be seen in which direction the key US market takes it during the current week.

Any indication of a change of course from the Fed would, of course, be significant here, as would anything that suggests a continuation or weakening of the current path.

by Lawrence Williams

Lawrence (Lawrie) Williams is a highly regarded London-based writer and commentator on financial and political subjects, specializing in precious metals news and commentary. He graduated in mining engineering from The Royal School of Mines, a constituent college of Imperial College, London. He has contributed articles on precious metals to the Financial Times, Sharps Pixley, US Gold Bureau and Seeking Alpha among others.

The opinions expressed in this article are the author’s own, do not necessarily reflect the opinions or views of Rosland Capital LLC or its employees, and do not constitute financial or investment advice or recommendations from the author or Rosland Capital or its employees. The author is compensated by Rosland Capital for his articles.

Coming Home to Roost: The Fed’s Inflationary Policies

November 18, 2021

Whether the current higher inflation levels in the US have been the Federal Reserve Bank’s intended policy all along is perhaps a moot point. We have to assume that although the central bank may have been working towards higher inflation levels, they are currently running above anticipated percentages.

Certainly the effective pumping of liquidity into the US economy to protect it from the depredations of the Covid-19 pandemic will, in hindsight, have led to an inevitable inflation rise.

But, in mitigation, one doubts that the Fed had foreseen quite how high, and how prolonged, the inflationary trend would be once it started to get under way.

The past week’s Consumer Price Index (CPI) reading has certainly brought the consequences home for all to see. It suggests an annual inflation rate of 6.2% – and this may well be an underestimate as the 0.9% monthly rise could even be pointing to a likely higher annual rate approaching 10%.

That is certainly the kind of price inflation already being seen by the American general public in its day-to-day shopping for energy, food and other staples. The higher levels also look to be borne out by the Producer Pricing Index, which is trending even higher than the CPI at over 8% year-on-year according to the latest figures.

Certainly the announced Fed policy had been suggesting a higher inflation rate to be desirable over and above the sub-2% levels that have been apparent over the past few years.

But one doubts that the central bank had foreseen the soaring levels we have just been encountering. Once inflation starts to take hold it can be hugely difficult to control.

The current inflation rate, if it persists, is certainly providing a major policy headache for Fed chair Jerome Powell. He has been persisting with an ultra-low interest rate policy to help the economy to grow and unemployment levels fall to the “maximum” percentage level of around 3.5% – around the pre-pandemic figure.

This has come down, but still not quite enough, which makes for quite a dilemma for the Fed. Should it raise interest rates sooner, rather than later, to try and bring inflation under control, or continue with minimal interest rates until unemployment falls to the target level?

The higher than anticipated CPI level of the past week has, on reflection by the markets, led to a significant price boost for gold and silver in particular, which they have managed to hold on to for the most part over the remainder of the week.

Gold thus managed to end the week of November 12th in the $1,860s and silver over $25. This was a nice leg up for both of them after recent disappointing performances.

In my view, both gold and silver will now consolidate around these levels before potentially making another upwards move with gold challenging $1,900 and silver $26 before the year end. Should that occur, it might pave the way for gold regaining $2,000 in the first half of next year.

Silver’s likely strength will depend perhaps more on industrial demand than movement along with the gold price as has been the case in the past. However, both elements could contribute to the metal’s price strength moving forwards. Even so I don’t see the silver price rising much above $27 in the short-to-medium term.

Platinum and palladium also saw price rises with the former doing better than the latter in percentage terms. The price gap between the two has narrowed, suggesting that price parity between the two most heavily traded platinum group metals (pgms) might be reached in the medium term after palladium had surged hugely ahead of platinum earlier in the year.

In retrospect, global central bank largesse will have inevitably led to inflation – the surprise may be that it seems to have taken quite so long to become apparent.

While I consider the US economy to be too strong and thus able to ward off what could be described as hyperinflation, current levels could still get worse before they begin to get better; that is with or without the Fed raising interest rates, although it will be under strong pressure to do so.

I have said before that the Fed is correct in describing some of the make-up of the current inflation rises as transitory and these will fall away as the pandemic is overcome. But this will take time to exit the system and we could well see higher levels in the meantime.

Even if the Fed does raise interest rates these increases may be too small to combat a perhaps prolonged period of negative real rates. This could lead to a further decline in dollar purchasing power and thus gold price strength.

Some observers see the dollar as overvalued. I am not so sure given equally strong, or even greater, inflationary pressures affecting many competing currencies as well.

Even so, purchasing power degradation could lead to a stronger gold price, particularly if we see equities and bitcoin start to come off their recent high points.

Gold, in my opinion, thus remains an excellent wealth protector.

by Lawrence Williams

Lawrence (Lawrie) Williams is a highly regarded London-based writer and commentator on financial and political subjects, specializing in precious metals news and commentary. He graduated in mining engineering from The Royal School of Mines, a constituent college of Imperial College, London. He has contributed articles on precious metals to the Financial Times, Sharps Pixley, US Gold Bureau and Seeking Alpha among others.

The opinions expressed in this article are the author’s own, do not necessarily reflect the opinions or views of Rosland Capital LLC or its employees, and do not constitute financial or investment advice or recommendations from the author or Rosland Capital or its employees. The author is compensated by Rosland Capital for his articles.